Overcrowding at Asian ports is affecting vessel schedule reliability with severe shipping delays and reduction in capacity. With the Red Sea crisis showing no signs of resolution, these delays and overcrowding are expected to continue throughout the summer.

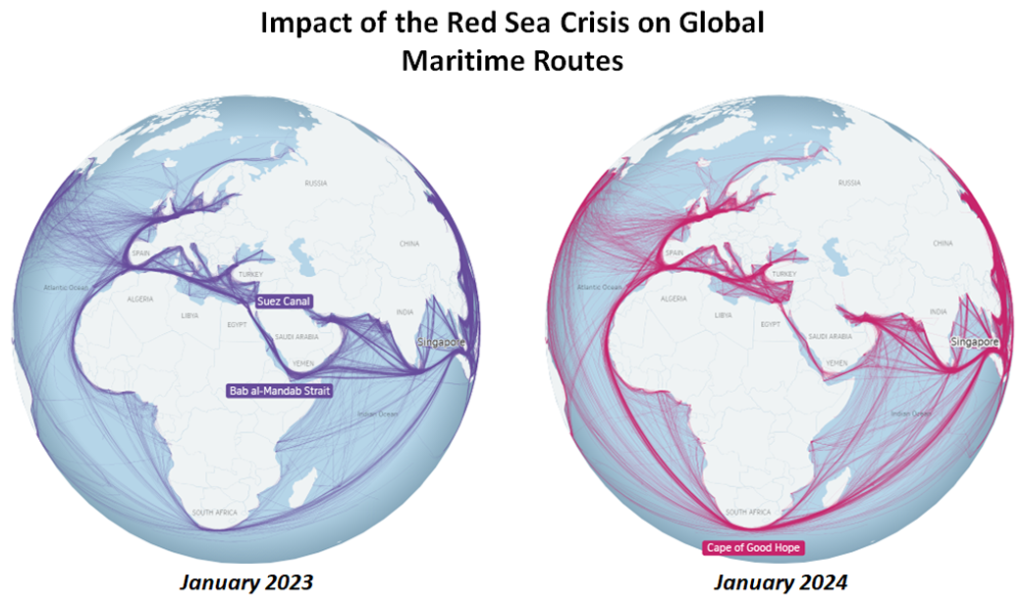

Since late last year, shipowners were forced to avoid the Suez Canal and divert to the longer route around Africa’s Cape of Good Hope. This extended route has caused severe delays to goods delivery, causing an increase in shipping costs. Maersk and other shipping companies have reported a 40% increase in fuel costs per journey and an anticipated 15-20% reduction in industry-wide capacity for the Asia-Europe route in the second quarter.

This route diversion prevents shipowners from refueling or unloading cargo at Middle Eastern ports which has added pressure on the marine traffic in the waters off various ports in Asia. In Asia, ports such as Singapore, Port Klang, Shanghai, Qingdao, Guangzhou, and Shenzhen are experiencing severe delays. Vessels are waiting up to four days to berth at Shanghai, two days at Qingdao, and up to three days at Port Klang. Singapore’s container volumes have risen nearly 9% in 2024, with average berthing delays of three to five days.

Last month, Singapore’s yard utilization hit nearly 90%, significantly above the optimal 70%. This is exacerbated by vessel bunching, terminal congestion, and longer dwell times. Nevertheless, there are early signs that shows easing of overcrowding in Singapore.

Analysts predict if congestion will persist, it is only in due time for this impact to ripple through to EU and US import destinations later this year. Many analysts have added that this issue will not be resolved anytime soon.

Two potential outcomes may arise from the situation

Firstly, transshipment networks need additional ships for feeder services, prompting carriers to withdraw vessels from other routes, especially in Northern Europe. This shift could lead to a capacity shortage and higher rates.

Secondly, port congestion effectively reduces available vessel capacity, leading to more blank sailings due to schedule gaps when ships are unavailable. This further tightens capacity and drives up rates.

In conclusion, the Red Sea crisis has caused major bottlenecks in Asian ports, disrupting global shipping routes and increasing operational costs. Although the industry is implementing strategic measures, the ongoing congestion highlights the necessity for resilient and adaptable logistics solutions from Asian ports. The situation is anticipated to persist until at least the end of 2024, with continued impacts on global trade.