The Iran-backed Houthi rebel based in Yemen have disrupted shipping in the Red Sea and Suez Canal, crucial in facilitating at least 17,000 ships annually through this region. This amounts to 12% of the annual global trade which is worth about USD1 trillion.

The Houthi rebel have intensified their campaign through drone and missile attacks against commercial vessels in the Bab-el-Mandeb strait, situated between the Arabian Peninsula and the Horn of Africa, since late November.

Currently, over 20 countries have joined the US-led Operation Prosperity Guardian, a naval task force aimed at defending against the Houthi rebel drone and missile attacks in the Red Sea. It had initially started with nine participants that included Bahrain, Canada, France, Italy, Netherlands, Norway, Seychelles, Spain, and the UK. The operation is still expanding.

The multinational security initiative, coordinated by the US Combined Maritime Forces and Task Force 153, responded to Houthi rebel attacks which impacted global trade. This multinational coalition serves as a “highway patrol” in the Red Sea and Gulf of Aden. The recent attack on the Maersk Hangzhou prompted a robust response from US Navy helicopters, resulting in three Houthi rebel boats sinking and thereby reinforced the operation’s significance in ensuring the safe passage for global shipping.

Concerns And Impact On Global Shipping

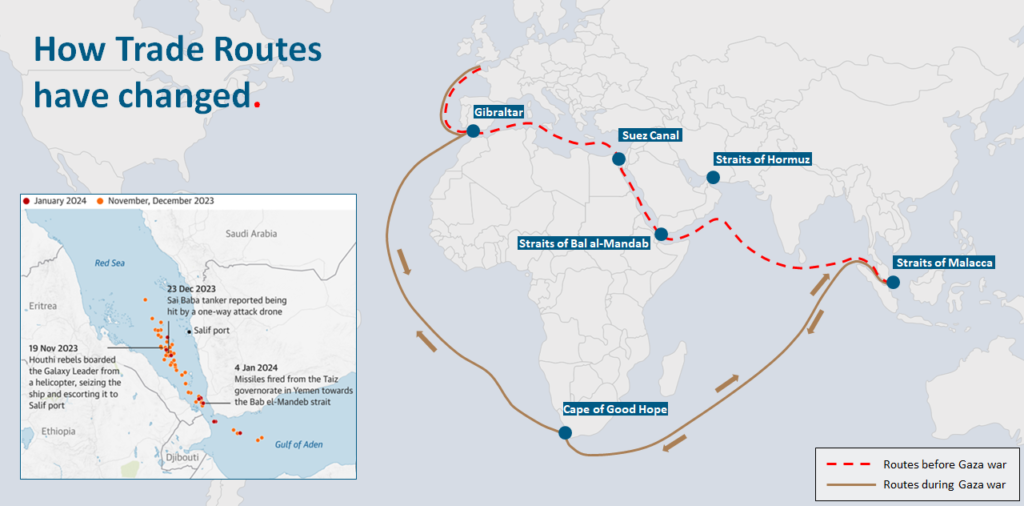

The global shipping industry is still being stifled by the Houthi rebel attacks in the Red Sea causing disruption to major trade routes and forcing leading carriers to re-organize their operations. This has not only led to an initial halt but also rerouting of voyages. Hence, significantly impacting the efficiency of maritime trade. These ramifications are reverberating globally, affecting container trade, container rates, and contributing to delays that resonate across the supply chain amounting to immense cost.

Since the US and UK’s joint airstrikes targeting Houthi rebel at the start of the year, underwriters have increased their fees, charging between 0.75% and 1% of the value of the ship to voyage across the region, reported Bloomberg. This insurance jump serves as a financial deterrent for shippers who are already having to deal with the transit fee for the Suez Canal.

Shipowners and charterers are thus beginning to consider alternative routes, particularly around the Cape of Good Hope. This resulted to an addition of at least 12 days to the usual shipping route which will unavoidably lead to shippers spending more on fuel and other operating cost. Insurance rate will eventually increase as well due to the sudden influx of maritime traffic due to numerous shippers re-routing from the Bal el-Mandab.

Altogether, this could result in the increased in shipping cost to around 40% to 60%, with higher insurance premiums to around 15% to 20%.

What Should We Expect

While the current situation for maritime operations has stabilized, resolution to the Red Sea crisis appears elusive, signaling a prolonged crisis lasting from months to potentially years. The impact on European-bound trade lanes remains significant, with the Transpacific and Far East trade routes also experiencing delays. The Red Sea developments have fundamentally altered the supply-demand equation for the first quarter of 2024.

Carrier partners are actively choosing to circumvent the Cape of Good Hope, indicating a commitment to long-term strategies rather than waiting for quick mitigation. This proactive response aligns with the perceived enduring nature of the situation. Current rates have surged threefold in the past month from Asia to North America and Europe. Shippers are advised to anticipate higher rates in the next three months, prompting considerations on managing through equipment shortages post-Chinese New Year, potentially leading to elevated rates.